GST Input Tax Credit Explained with interesting animation YouTube

Input Tax Credit under GST with Examples (Unlimited Guide)

Mixed purchases (both taxable and GST-free and/or input-taxed components) Mixed purchases contain both a taxable component and a GST-free and/or input-taxed component. On your BAS, you report the GST in the price of only the taxable component at 1B GST on purchases. Table 6 below contains a list of mixed purchases and their descriptions.

INPUT TAX CREDIT GST PART 2 CLASS 10 ICSE YouTube

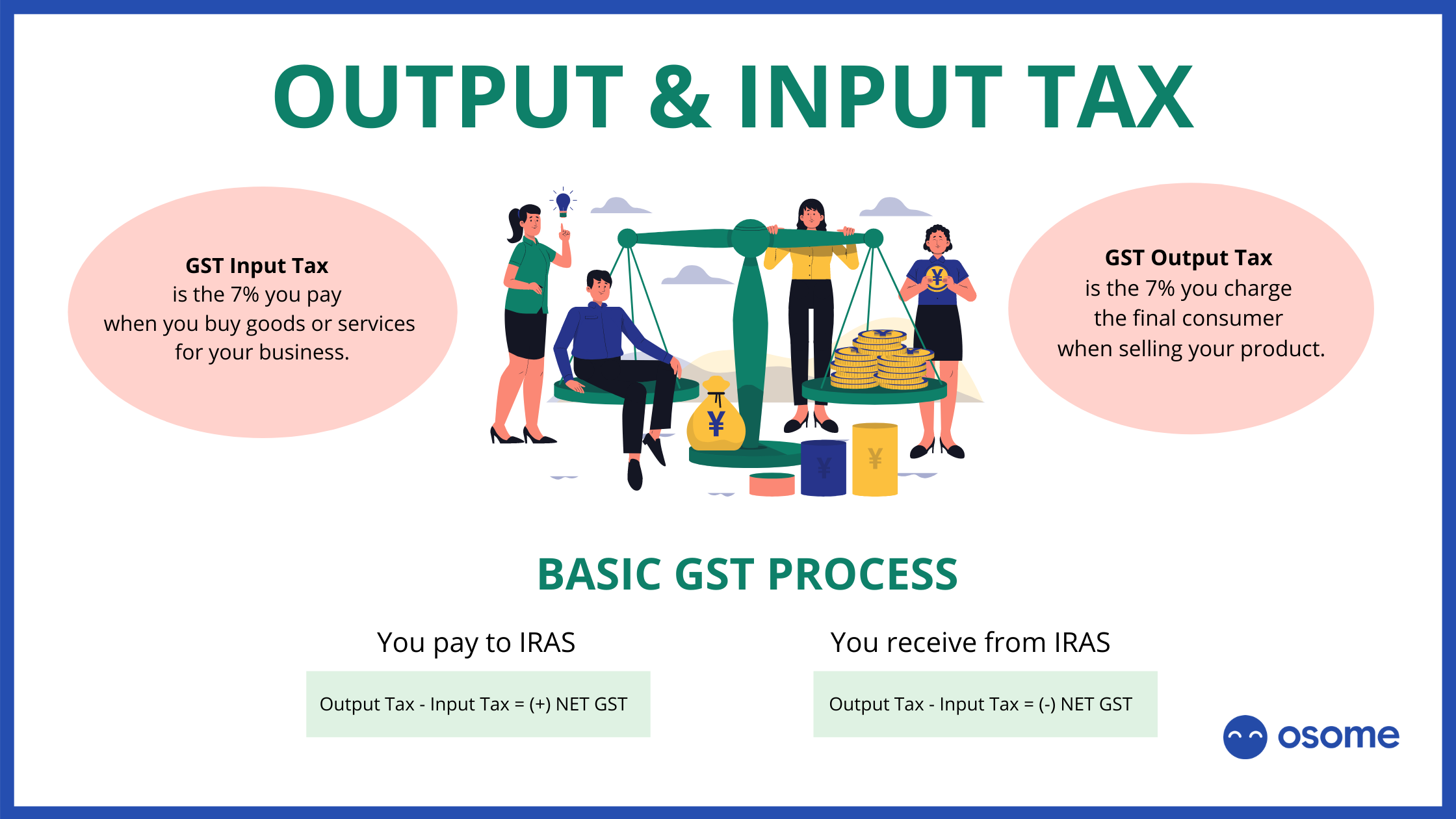

GST. GST is a form of "valued added tax" (commonly referred to as VAT in overseas jurisdictions). It applies to "taxable supplies" at a rate of 10% and is calculated based on the value of the supply. Input tax credits (GST credits) are available for GST incurred on costs that relate to making taxable or GST-free supplies.

GST Input Tax Credit YouTube

Print or Download. Input-taxed sales are sales of goods and services that don't include GST in the price. You can't claim GST credits for the GST included in the price of your 'inputs'. The most common input-taxed sales are financial supplies (such as lending money or the provision of credit for a fee) and selling or renting out residential.

GST For Normies Part 2 Talk of Many Things

Table 6: Mixed purchases (both taxable and GST-free and/or input-taxed components) Transaction: Transaction description: GST tax code/Manual override: Completing your BAS: Utility bills:electricitytelephoneinternet : You may claim credits on connection fees, supply and usage charges and call usage that is domestic. You cannot claim GST on.

GST Input tax credit reversal second proviso to section 16 (2) 180 Days payment rule in GST

input-taxed; GST-free. See GSTR 2006/9 Goods and services tax: supplies. Self-assessment. The self-assessment system for indirect taxes began on 1 July 2012. When lodging activity statements or GST return for tax periods that begin on or after that date, you must include the indirect tax payable amounts and any credits that make up your net amount.

Input Tax Credit under GST (2023 Guide) InstaFiling

Circular No. 160/16/2021-GST. 3. provisions of section 16(4), as it existed before the said amendment on 01.01.2021. Illustration 1. A debit note dated 07.07.2021 is issued in respect of the original invoice dated 16.03.2021. As the invoice pertains to F.Y. 2020- 21, the relevant financial year for availment of ITC in respect of the said.

All about Input Tax Credit under GST India Pvt Ltd

Understanding what an input tax credit is and why it matters is crucial for small businesses. Once your business's turnover reaches A$75,000 or more, you must register for goods and services tax (GST).However, in addition to making GST payments, it is important to recognise that you may also be entitled to claim credits for any GST included in the price you paid.

Itc Rules Under Gst Guide On Types Conditions Eligibility Input Hot Sex Picture

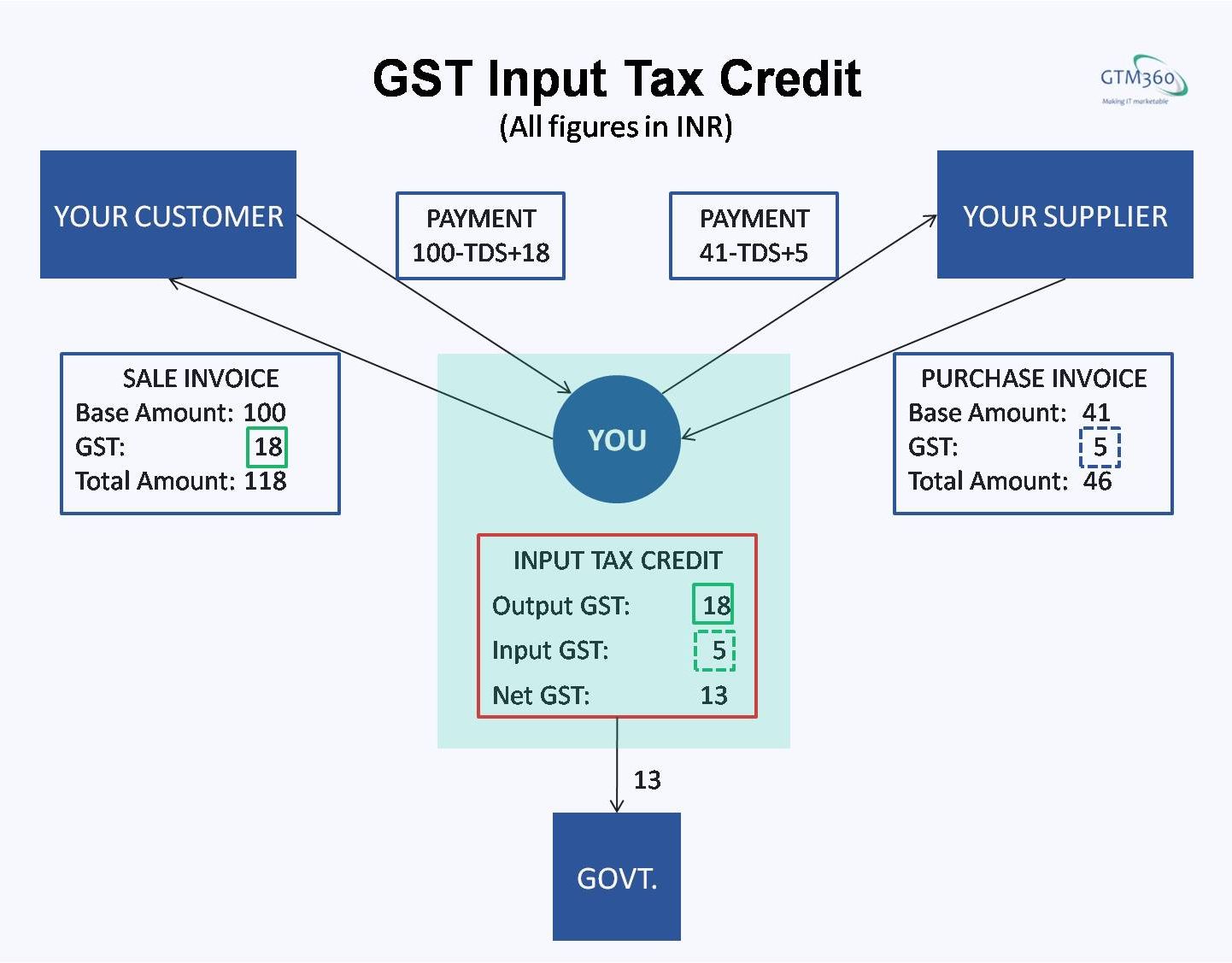

The GST will be 10% of $100 = $10. The retailer, therefore, collects $110 from the customer and pays the $10 to the ATO. Credit is provided for the GST paid along the chain by entities making taxable supplies which are called an "input tax credit". The credit is only available to entities registered for GST.

A COMPLETE GUIDE TO INPUT TAX CREDIT (ITC) UNDER GST TAXCONCEPT

Input taxed sales and GST free sales are both considered income and both do not attract GST. The Australian taxation office has a set of clear rules defining the two types of transactions which can be summarized as follows: Input taxed sales are sales in which attract no GST and also are not allowed to be offset with GST on purchases involved.

How to avail input tax credit in gst? YouTube

What is an input-taxed supply? This is a supply that the seller cannot charge GST on and also cannot claim any GST incurred in relation to that supply. There are input taxed sales and input taxed purchases. Input taxed sales are things like interest income, dividend income, or residential income. Input taxed purchases are expenses related to.

Input Tax Credit GST and Place of Supply GST YouTube

GST Free Capital; Input Taxed; GST on Capital Imports; GST Free Exports; Custom rates you've created aren't affected. If you want to use the advanced tax rates again, you can change back to them. When you select basic tax rates, tax rates of transactions already entered don't change, unless they are draft transactions. If you edit a.

Input Tax credit under GST Input Tax credit under SGST,IGST,CGST NRC Advisory

The spark plugs and brake pads are GST-free for John. If John later has the spark plugs and brake pads fitted by a mechanic, the labour will be a taxable sale because it is a separate supply of labour, not a sale of car parts. Example 2: GST-free sale of car parts including labour for fitting the parts.

Eligibility & Utilisation on Input Tax Credit Under GST

GST free sales. You cannot include GST on GST free sales (but you can still claim credits for the GST included in the price of taxable purchases, or inputs, you use to make these types of sales). Things that are GST free include: Input taxed sales. What are input taxed sales? Certain goods and services can be sold without including GST in the.

GST input tax credit YouTube

Claiming back GST (and input tax credits) GST-registered businesses can claim back the GST they pay on business expenses. Let's learn how to claim it.. Start using Xero for free. Access Xero features for 30 days, then decide which plan best suits your business. Safe and secure. Cancel any time. 24/7 online support.

Goods and Services Tax (GST) in Singapore What Is It?

GST is a tax imposed on the sale (supply) of a wide range of goods and services consumed in Australia. In general, an organisation that is required by law to 'register' for GST or that has voluntarily registered for GST: GST is generally payable by a supplier at a flat rate of 10% of the value of a taxable supply unless special rules apply.

Decoding Input Tax Credit (ITC) under GST

The two main input-taxed goods and services are financial products (such as loans) and the sale or lease of residential properties. GST-Free Goods and Services. While this list is not exhaustive, it includes the main GST-free products and services utilised by business owners in Australia. Goods and services that are generally GST-free:

.