Withholding Tax Explained Types and How It's Calculated

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID1098893

In Australia, "tax withheld" means the income tax deducted from employee's wages or payments. It remits directly to the Australian Taxation Office (ATO) on the employee's behalf. Tax Withheld ensures year-round income tax payments, rather than significant tax billing at the financial year. Tax withheld is a crucial part of the.

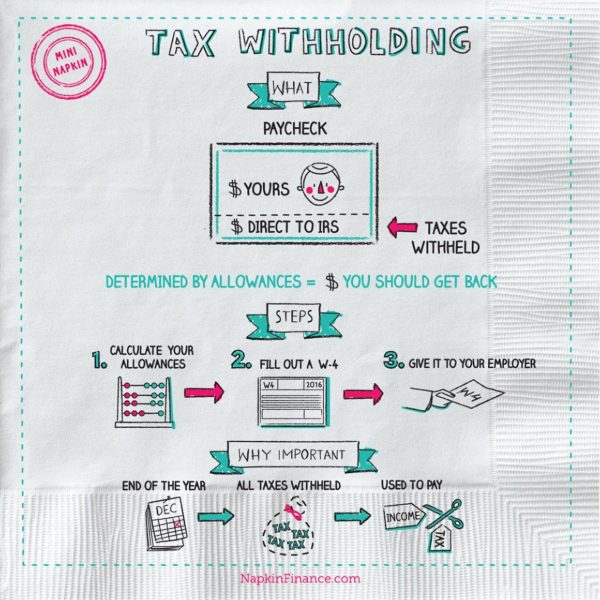

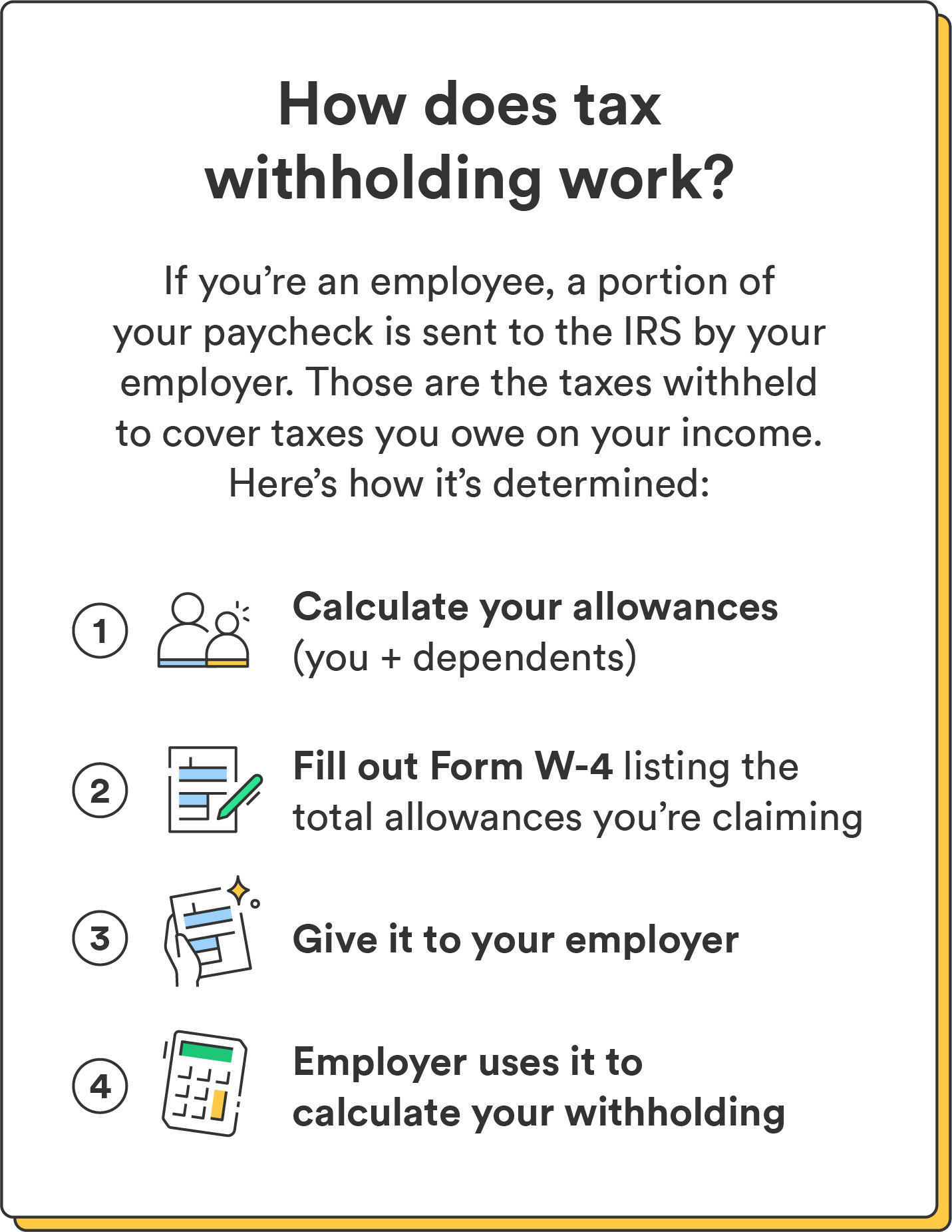

What is Tax Withholding? All Your Questions Answered by Napkin Finance

Withholding tax on a savings account is calculated at the top marginal tax rate of 45 per cent with the additional Medicare levy of 1.5 per cent. Withholding tax applies to non-residents of Australia as well, and for them, the withholding tax rate is 10 per cent. Withholding tax comes into effect if your saving account earns more than $120 per.

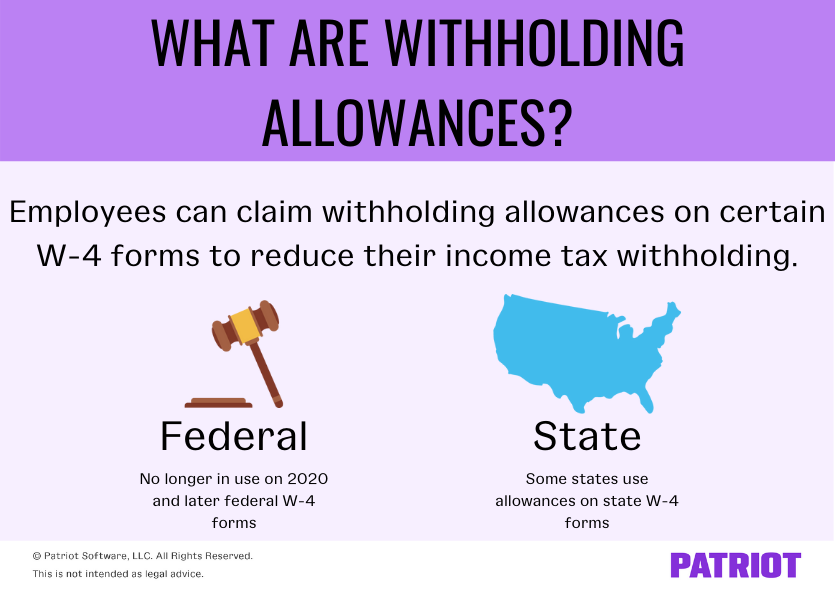

Withholding Allowance What Is It, And How Does It Work In, 44 OFF

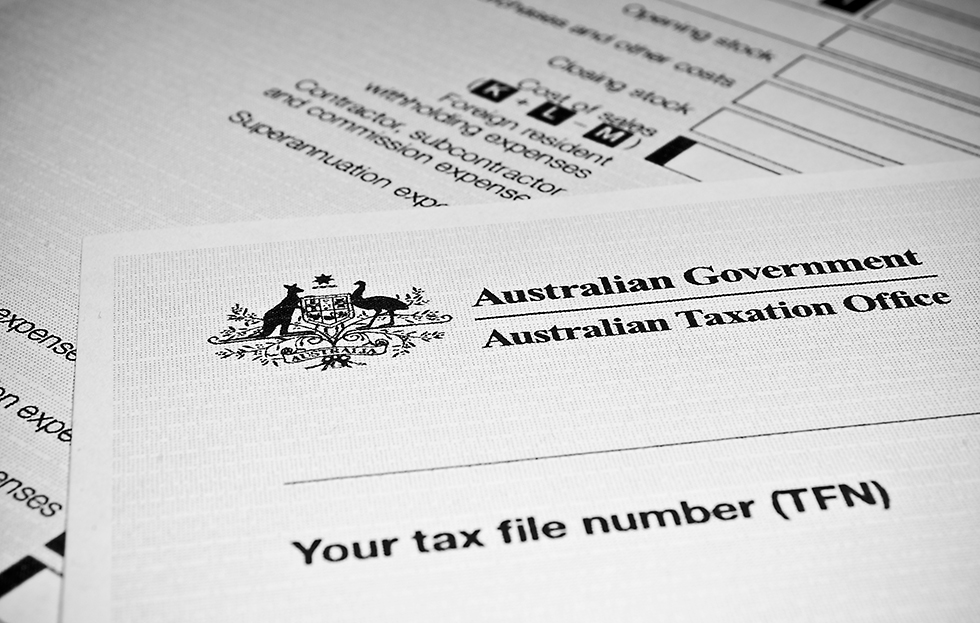

How tax works. The Australian Taxation Office (ATO) collects taxes for the Australian Government. The taxes everyone pays, fund community services like: payments for welfare, disaster relief and pensions. Your pay slip shows how much tax you've paid. Find out more about what your pay slip should include on the Fair Work Ombudsman website.

A quick guide to taxes in Australia Australia Property Guides

A withholding declaration is an important document designed to provide individuals with control over the amount of tax withheld from their income by their employer or payer. By completing this form, you have the opportunity to specify the exact amount of tax you wish to be deducted from your earnings. This declaration becomes particularly.

What Does Social Security Tax Withheld Mean? Retire Gen Z

Key Takeaways. PAYG withholding enables workers to pay their tax bill periodically throughout the year, instead of in one lump sum. This requires businesses to register and pay the withheld money to the ATO on behalf of its workers. A company is obliged to register for PAYG if it has: employees; directors;

At a glance Treasury.gov.au

Contractors need to calculate and pay their income tax quarterly. Suggested Read: What Does Tax Withheld Mean in Australia? For Example: If an independent contractor earns $60,000 annually, they need to set aside a portion for tax payments and make quarterly installments to the Australian Taxation Office (ATO). Superannuation Contributions:

Taxation Defined, With Justifications and Types of Taxes

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

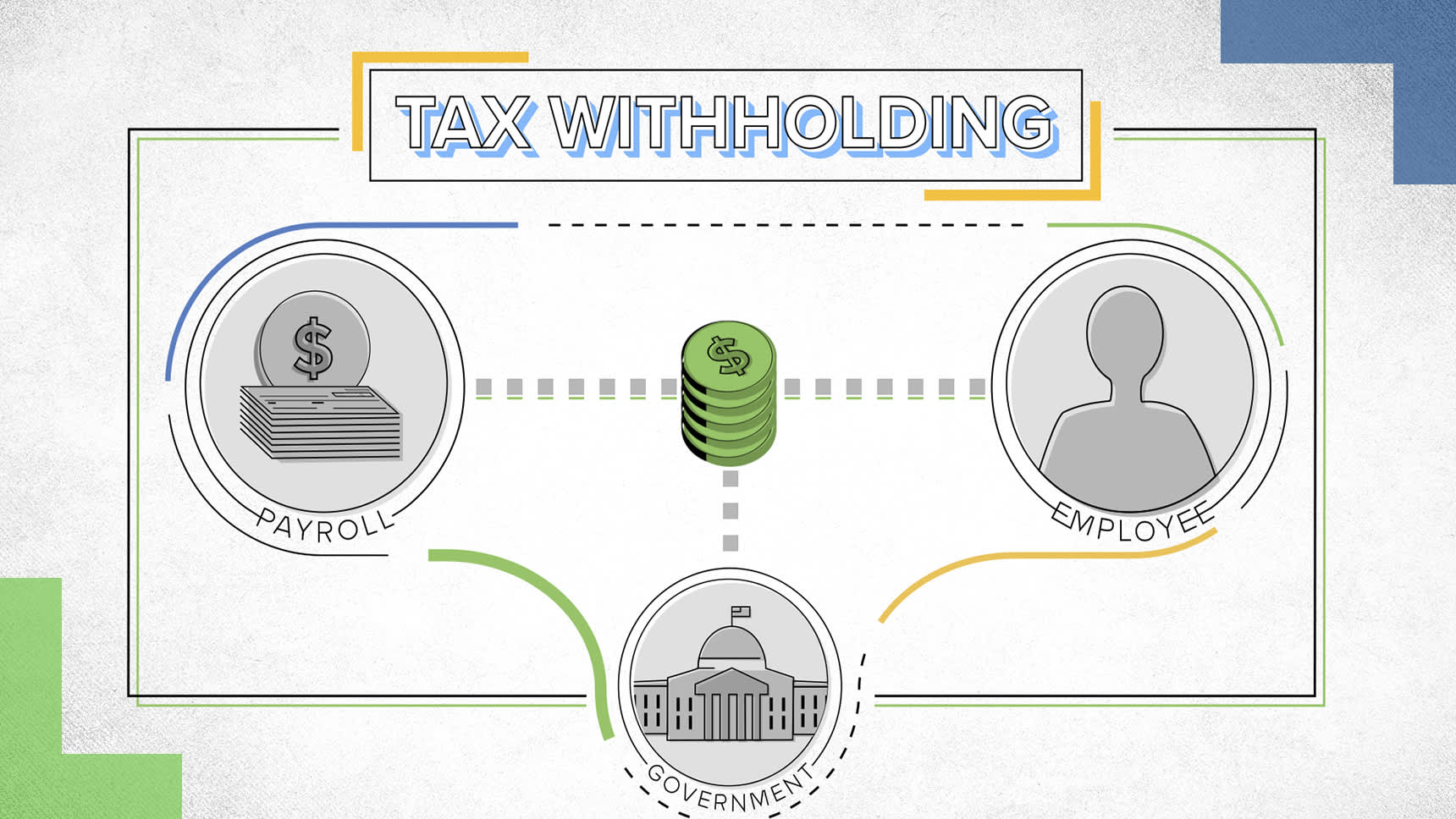

Withholding tax is what employers deduct from gross wages to pay directly to the Australian Taxation Office (ATO). It is essentially an income estimated tax credit, which means if too little is taken, your employee could end up owing money at the end of the tax year. Conversely, if you take too much, they could be due a tax refund.

How Does Australia's Tax Rate Compare To The Rest Of The World? [Infographic]

The source country exempts inter-corporate non-portfolio (i.e. minimum 10% shareholding) dividends paid out of profits that have borne the normal rate of company tax. There is a 5% rate limit for all other non-portfolio dividends. A rate limit of 15% applies for all other dividends. A rate limit of 10% applies to interest, except no tax is.

What Is Tax Withholding? Chime

PAYG withholding or PAYG-W is a system that allows employers to make pre-payment on behalf of the employees for their income tax obligations. PAYG withholding helps employees avoid facing a large tax bill by the end of the financial year. As an employer, if you know how PAYG withholding obligations operate, you and your employees will have it.

Taxes Australia stock photo. Image of advisor, time 92695224

The tax table shown above is the Fortnightly Tax Table. For example, if your fortnightly income amounts to $712 and you have selected 'YES' to the question, 'do you want to claim the tax-free threshold from this payer?' on your TFN Declaration form, then your employer must pay you the full amount of $712 without deducting any taxes. Please take the time to look through the income range.

What Is Tax Withheld Means TAXP

What is PAYG withholding in Australia? PAYG withholding is an accumulative tax that employers pay to the Australian Taxation Office (ATO) for businesses in Australia on behalf of their employees. The simplest way to ensure you meet your obligations is to use Single Touch Payroll (STP), a process that automatically reports to the ATO so you don.

What does withholding tax mean? YouTube

Print or Download. The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. Alternatively, you can use the range of tax tables we produce. These take into account the Medicare levy, study and training support loans, and tax-free threshold. Next steps.

PPT What Does Tax Withheld Mean in Australia_ PowerPoint Presentation ID12626078

A: The income tax you pay is based on your how much income you earn. So, the higher your income, the higher the percentage of tax you will pay. The main way to reduce tax at tax time is to claim eligible work-related deductions. Make sure you spent the money yourself and weren't reimbursed for it, it relates directly to your employment, and.

Taxation Advice and Support DBA Accountants

The tax withheld calculator will include any additional amounts for study and training support loans in the withholding amount if they apply. Displaying the results.. If your payee is an Australian resident for tax purposes, $18,200 of their yearly income is not taxed. This is called the tax-free threshold.

How To Avoid Withholding Tax Economicsprogress5

PAYG Withholding operates as follows: Calculation of Withheld Tax: When an employer pays wages to an employee, they are required to calculate and withhold a specific amount of tax from each payment. The calculation is based on the employee's income and tax bracket. The tax rates and thresholds are determined by the ATO and are subject to.

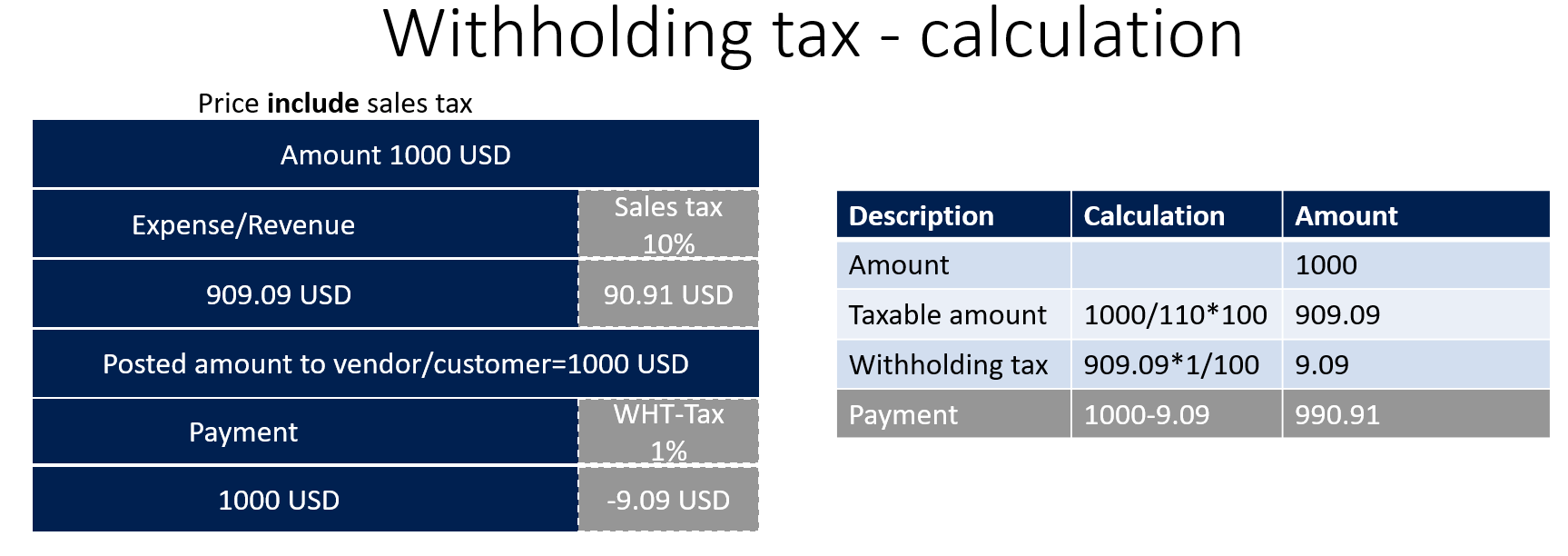

Understanding withholding tax Microsoft Dynamics 365 Enterprise Edition Financial Management

The ATO explains that if you are a foreign resident, your Australian bank will automatically withhold tax on any interest earned on savings accounts. The rate of tax withheld depends on whether you let the bank know your overseas address. If you provide an address, withholding tax works out at 10%. Without details of your overseas address, tax.

.